Briefly Explain the Difference Between Gross Profit and Net Profit

To arrive at the net profit other applicable deductions would be subtracted. Here are some ideas.

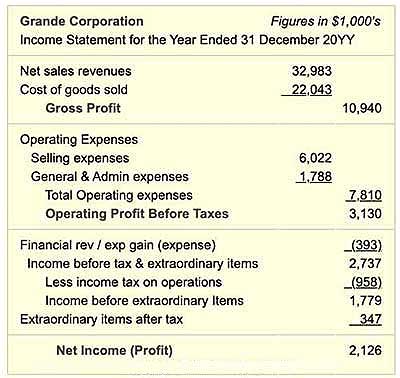

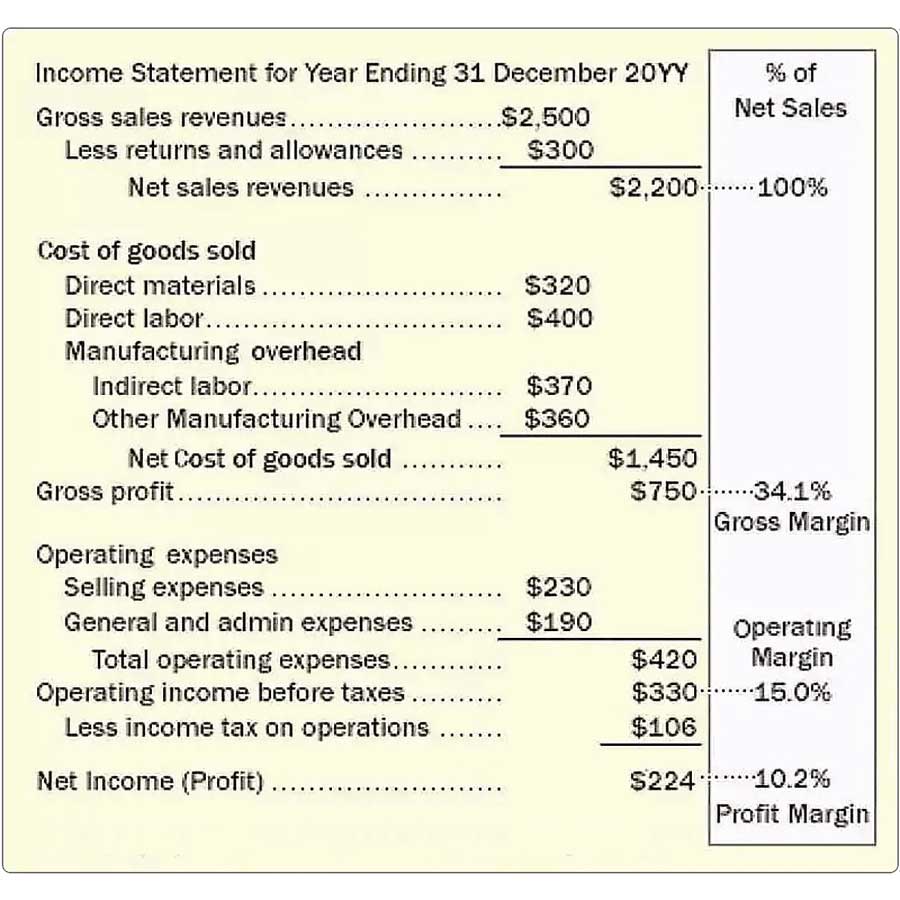

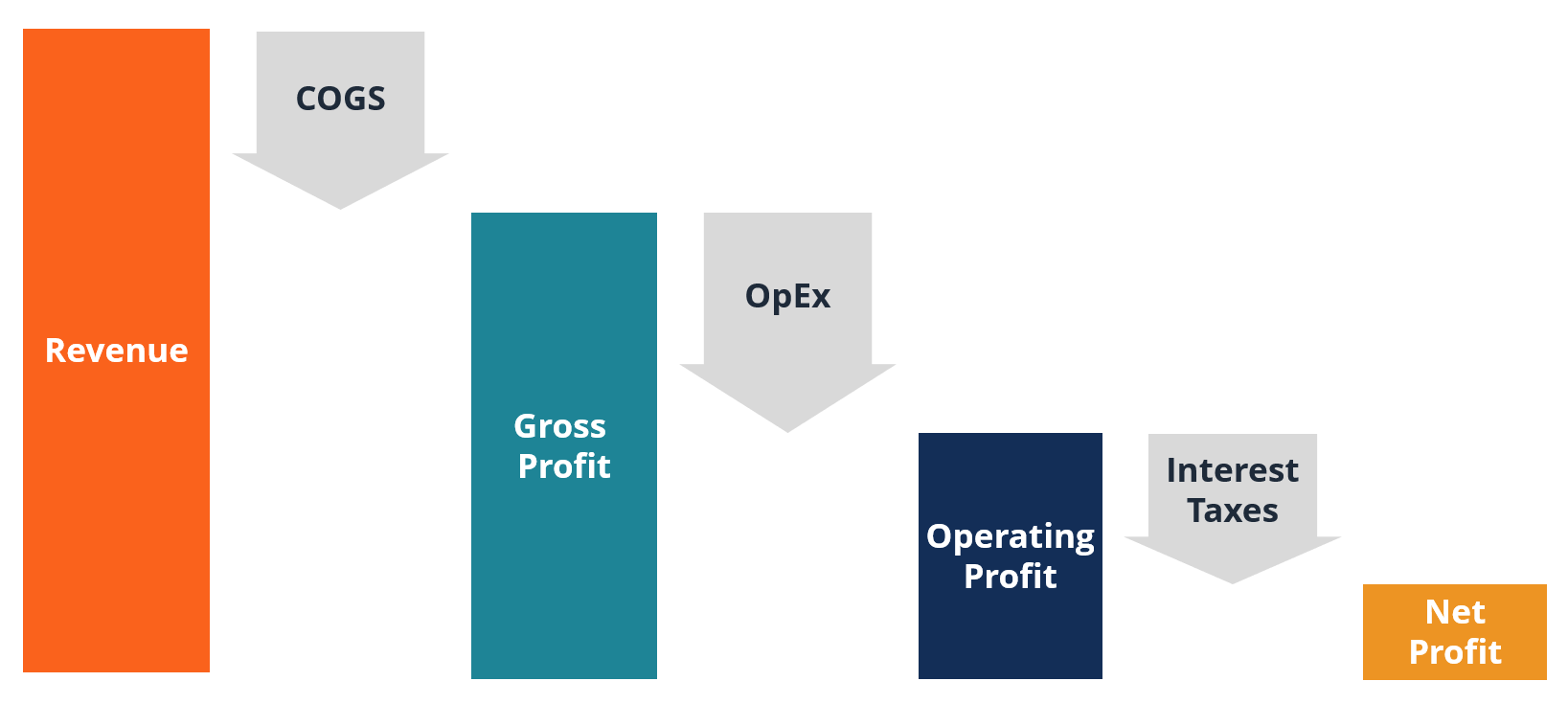

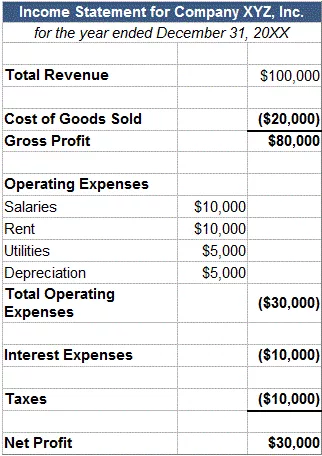

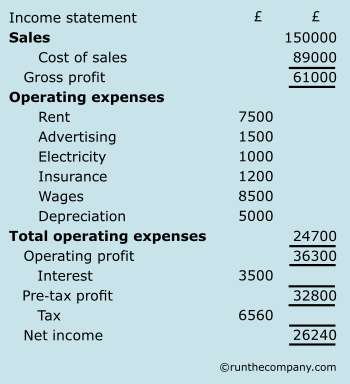

How Income Statement Structure Content Reveal Earning Performance

The gross profit margin can be calculated by dividing gross profit by revenue.

. So just to recap profit is the financial gain a business acquires. Gross profit is total sales minus total cost of goods. To calculate the net profit you have to add up all the operating expenses first.

Net income on the other hand is the money that is left after all applicable expenses have been deducted. Do you know the difference between gross profit and net profit when it comes to running a business. The Gross profit represents the credit balance of the business account.

In last weeks blog we explained the difference between profit and cash. Also a higher gross profit ratio indicates that operational cost is low. In short gross profit is your revenue without subtracting your manufacturing or production expenses while net profit is your gross profit minus the cost of all business operations and non-operations.

For example if a company has revenue of 200000 with cost of sales of 120000 the gross profit margin is 40. Gross profit is calculated by deducting the cost of goods sold of a particular business from the net sales. The gross profit formula is.

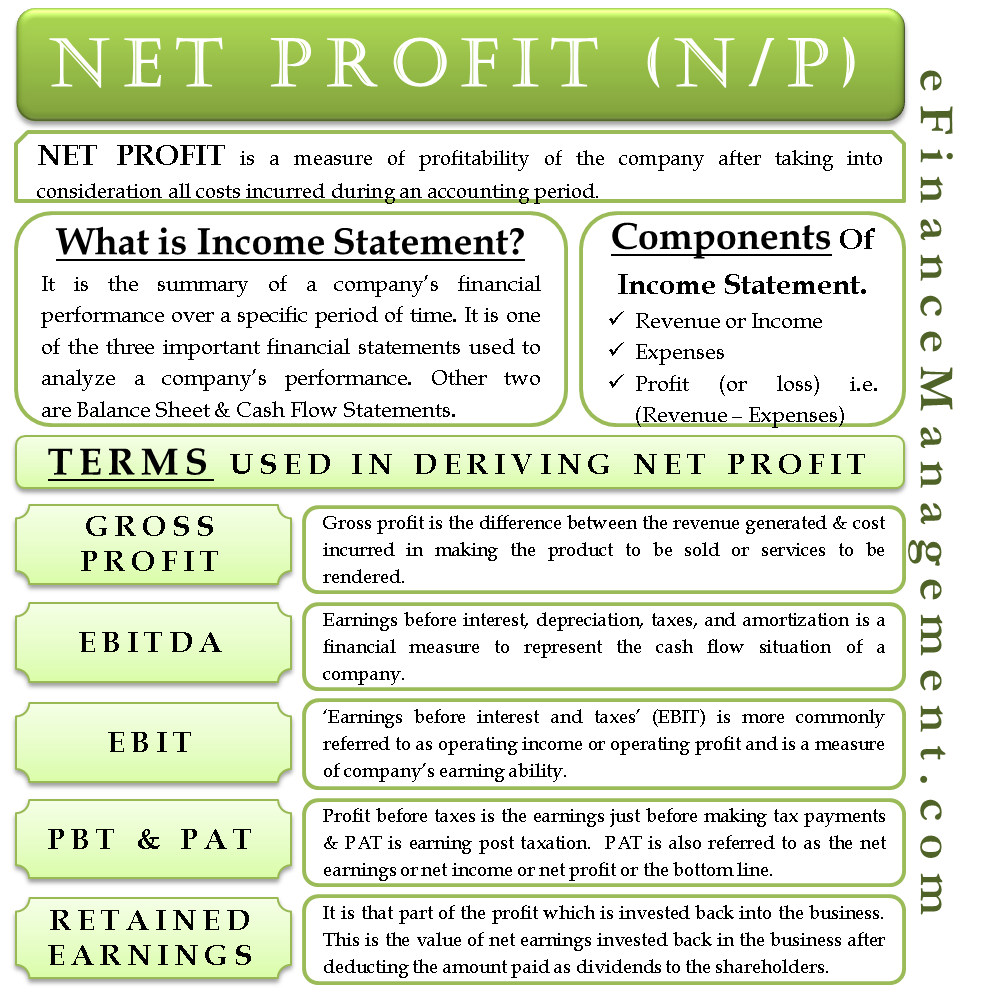

Gross Profit is defined as the total amount of profit that is made from sales. Up to 25 cash back Gross Profit. Solution for Briefly explain the difference between gross profit net profit and EBIT.

It does not take into account operating expenses. Net profit margin The net profit margin is a more accurate measure of a businesss profitability. Is defined as The amount of money left over from revenues after accounting for the cost of goods sold Net Income.

So in trying to establish exactly how much a company has made as a result of the sale of its products investors would look at the gross profit to get a general idea. Net Profit Total Revenue Total Cost. To calculate the net profit margin you simply have to divide net profit by revenue.

It is also called Net Income Net Earnings. However each metric represents profit at different parts of the production cycle and earnings. Up to 25 cash back If a person sells a product that their cost of the product was 10000 and they sell it for 20000 the gross profit would be 10000.

One of the main difference between gross profit and net profit is that the two accounting terms are defined differently. Gross is the total amount of fish in the sea but all that really matters is how many fish are in your Net this is how Richard Branson was first taught the difference between Gross and Net. Cash flow and profit are both important financial metrics in business and it isnt uncommon for those new to the world of finance and accounting to occasionally confuse the two terms.

Net profit is calculated by deducting all the expenses and costs from the revenue. This implies that profit after all deductions is called Net Profit. What is net profit.

Real profit with no costs to be taken away is pure profit. Successful businesses show a positive value for gross profit. On the other hand net profit is a useful metric for investors and financial analysts.

Specifically net profit takes into account your operating costs like rent utilities payroll or website hosting to give you a more conclusive figure of your profits. In most businesses net profit is always lower than gross profit. And then work together to come up with some examples.

But cash flow and profit are not the same things and its critical to understand the difference between them to make key decisions regarding a businesss performance and. Gross profit gives rough profits but net profit gives real profits. Like gross profit net profit can be a percentage.

200000 50000 150000. It is also known as the bottom line. Net profit is the gross profit revenue minus COGS minus operating expenses and all other expenses such as taxes and interest paid on debt.

Gross is the total and Net is the part of the total that really matters. The Net Profit determines the credit balance of the profit and loss account. Learn what these terms mean here.

Gross profit describes the profit that an organization is left with after deducting all the direct expenses that. Although it may appear more complicated net profit is. Is defined as A companys total earnings or profit- often referred to as the bottom line since net income is listed at the bottom of the income statement.

Gross profit Total revenue Cost of goods sold. Net profit uses your gross profit to calculate how much money you have left over after paying your other costs. Deductions include adjustments related to the cost of doing business such as taxes depreciation or other miscellaneous expenses.

It is a significant figure to compare the profitability and commercial performance of a company. The main difference between gross profit and net profit is gross profit is invaded by subtracting the total cost of goods sold from the total yield. Now wed like to dig a little deeper and explain the difference between gross profit versus net profit.

Gross profit Net sales - Cost of goods sold. Like commissions on the sale advertising federal and state income taxes administrative expense operating overhead etc. The money accounted as gross profit pays for expenses like overhead costs and income tax.

Net Profit is the gross profit minus all operating expenses. It is the difference between total revenue earned and total cost incurred. Gross profit is total revenue minus the cost of production.

On the other hand net profit is obtained by subtracting the indirect and direct expenses from the total yield. What is the difference between Net Profit and Gross Profit. Gross profit operating profit and net income are all types of earnings that a company generates.

Gross profit offers a fair idea about the proficient use of raw materials labour and capital. It is the total revenues minus the total cost of goods sold. Net profit is arrived at after deducting operating expenses from gross profit.

Gross Profit Margin Vs Net Profit Margin Formula

Profit Margin Guide Examples How To Calculate Profit Margins

Difference Between Gross Profit And Net Profit Difference Between

:max_bytes(150000):strip_icc()/dotdash_inv-gross-profit-operating-profit-and-net-income-july-2021-01-48310634db4240ba9a78ef19456430af.jpg)

Gross Profit Operating Profit And Net Income

How Income Statement Structure Content Reveal Earning Performance

Profitability Ratios These Ratios Measure How Efficiently A Company Generates Profits From Its Utilized Resources Shared Finances Finance Investing Net Profit

Difference Between Gross Profit And Net Profit Difference Between

Profit Overview Examples Of Gross Operating And Net Profit

Gross Profit Margin Vs Net Profit Margin Formula

Net Earnings Definition Formula Investinganswers

Difference Between Gross Profit And Net Profit Difference Between

Google Image Result For Https Www Patriotsoftware Com Accounting Training Blog Wp Content Uploads 2018 10 Gross Profit Net Profit Profit Accounting Training

:max_bytes(150000):strip_icc()/dotdash_Final_Gross_Profit_Operating_Profit_and_Net_Income_Oct_2020-01-55044f612e0649c481ff92a5ffff1b1b.jpg)

Gross Profit Operating Profit And Net Income

Net Profit Income Statement Terms Ebit Pbt Retained Earnings Etc

Gross Profit Margin Vs Net Profit Margin Formula

Understanding Profitability Ag Decision Maker

Income Statement Runthecompany

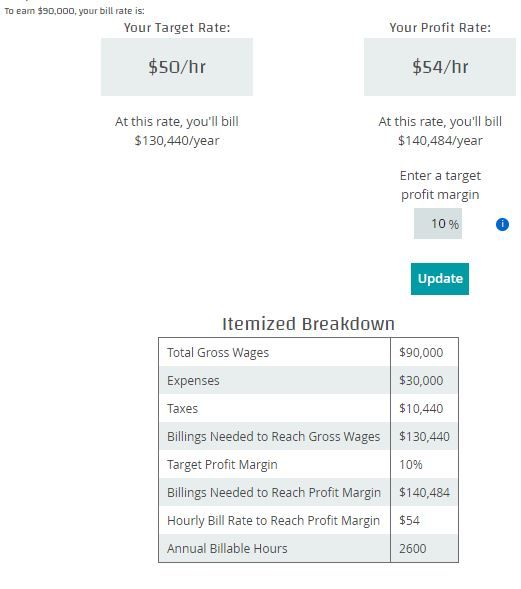

Gross Vs Net Income Differences And How To Calculate Mbo Partners

/dotdash_inv-gross-profit-operating-profit-and-net-income-july-2021-01-48310634db4240ba9a78ef19456430af.jpg)

Comments

Post a Comment